Porinju Veliyath 18th October 2023

"At bottom the ability to buy securities - particularly common stocks - successfully is the ability to look ahead accurately. Looking backward, however carefully, will not suffice, and may do more harm than good." - Benjamin Graham

Dear Investors,

Indian markets have done reasonably well over the past 3 years in contrast to the significant drop, first of small and midsize companies in 2017-18 and then general meltdown due to Covid breakout in early 2020. Indian markets in general have stayed ahead of the global markets and have been quite resilient. As we stand today, a few typical concerning thoughts come to investors mind:

- Are valuations rich and is it time to book profits?

- Host of news around geo-politics. How is India likely to be affected?

- FII have sold in the past few weeks due to rising yields in the US. How does that play out over time?

First and foremost, we are “Value Investors” and have no special insight around every macro event, nor do we believe it matters beyond a point to long term discerning investors. If a portfolio is created with margin of safety, it is likely to endure such market phases and investors need not be very paranoid about every headline. As fiduciary decision makers of managing our clients’ wealth, we strongly believe that our team is well positioned behaviorally to do the right things despite overwhelming news headlines. Of the three points mentioned, we would lose sleep only if we misread the first point and not the other two. Point two and three do capture the “current risk narrative” but don't alter long term IRR potential of well-crafted business portfolio of India equities to our mind. Nonetheless here are some very broad views we have as of now.

Indian economy structurally - “Resilient” and “Growth tuned”

The deadly faceoff between the Hamas and Israel, which happened in the backdrop of the ongoing Russia-Ukraine War and simmering tensions between China and Taiwan, has ratcheted up geopolitical risks—jolting afresh an already battered global economy and accelerating geo-fragmentation. It is clearly leading to several shocks to the trade supply chain and driving up the risk of commodity price inflation and reducing the growth prospects across the world. In India’s case, global supply chain reorientation under new global dynamics is in fact opening real opportunities. India is becoming an extremely important alternative manufacturing base not only to China but also to part of Europe and we believe that this is a structural trend likely to play out more and more with rising shifts in geo-politics. Also, India’s young demography and large domestic infrastructure formation has potential to allow India to keep growing despite global deceleration. Despite sharp rise in the food and oil prices globally, India has managed inflation relatively well and with our food sufficiency and continued smart arrangement with most global large oil producers; going forward also it should be reasonably controlled.

In the past, oil price shock and poor monsoon used to derail the Indian economy. Investors need to adapt to the reality that the Indian economy has passed the threshold in size and those risks which used to raise huge red flags in the past are not that much of a risk now. The Indian economy is structurally both “resilient” and “growth tuned” now. Investors who panic on every bad global headline will not be acting out of wisdom. To be good at investing is to learn from the past cycles but also unlearn some influences of the past which tend to become redundant in the next phase of the economy.

Indian Equities and Indian Investors

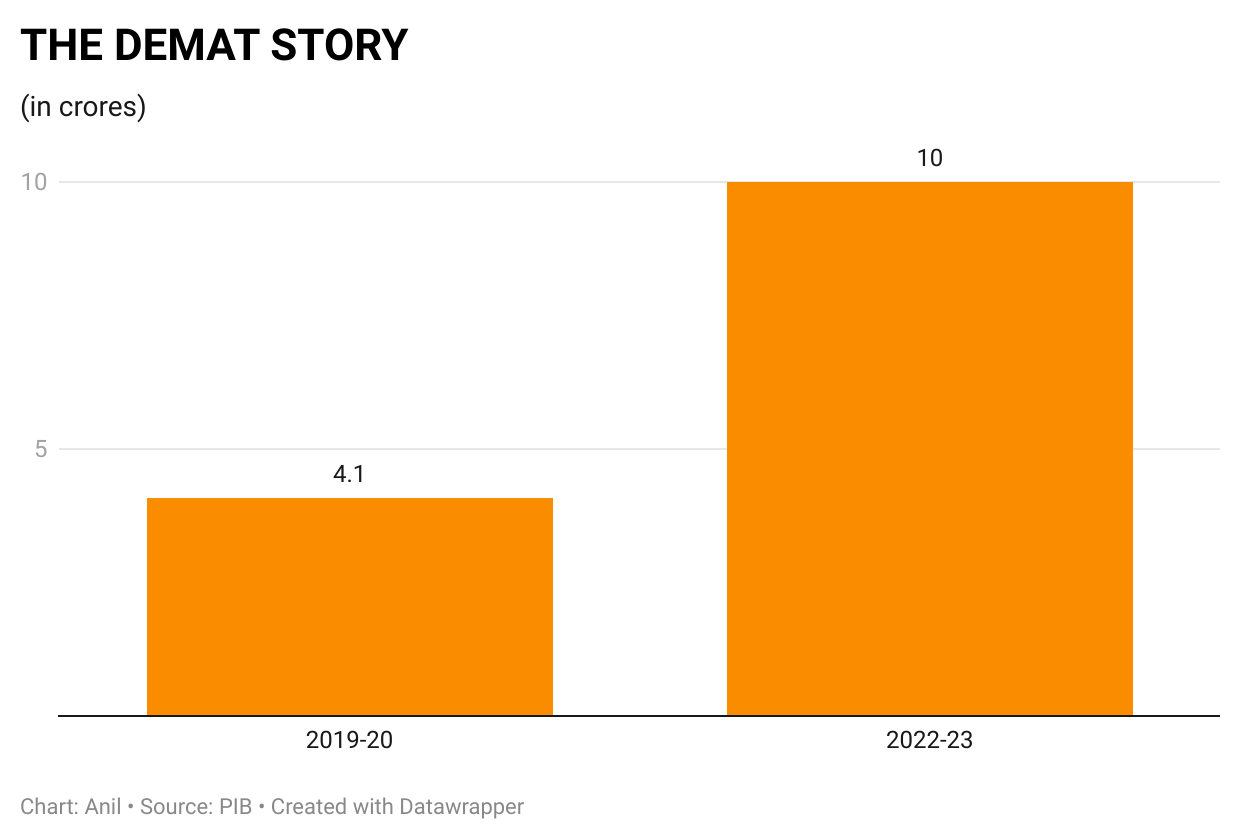

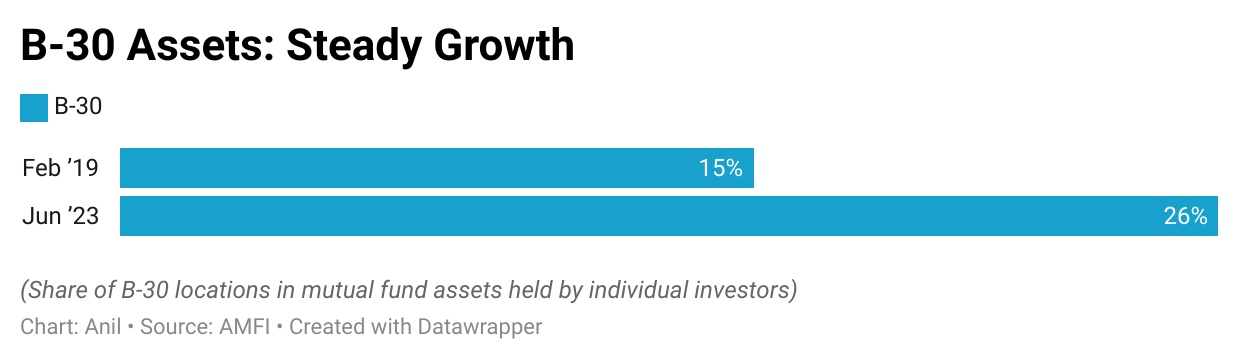

In September, Indian equities experienced a significant withdrawal with the departure of $2.2 billion of FII money. This marked one of the steepest single month declines since January, influenced by the swift surge in the US borrowing costs affecting risk assets. Historically, the momentum of Indian stock markets had been maintained by the inflow of FIIs; but that is not the case anymore. For instance, in September, DIIs infused Rs 17,561 crore into equities, following an inflow of Rs 22,611 crore in August. Since January, entities like mutual funds, insurance companies, and banks have collectively invested a net sum of Rs 127,219 crore in equities. Data as well as our ground up intelligence show that a rapid structural shift in saving patterns of the Indian households, especially among youth, is driving the Indian markets. We believe, as Indian per capita income rise, saving patterns would consolidate further towards equities and allied instruments. Trends of the past few years can be seen in demat account openings and asset growth of mutual funds as depicted below.

The principle of "Atmanirbharta" or self-reliance is a dominant theme in economic discourse, with growing DII flows reflecting this ethos in the stock market landscape. Traditionally, retail investors have been somewhat reserved in their engagement with equities. Yet, contemporary trends depict a change, as an increasing number are gravitating towards consistent investment avenues, signaling a long-term commitment. This shift towards autonomy is primarily credited to the steady rise in DII flows, fueled largely by the active participation of retail investors, especially through the regular SIP channel.

Time to be “nuanced” about stocks

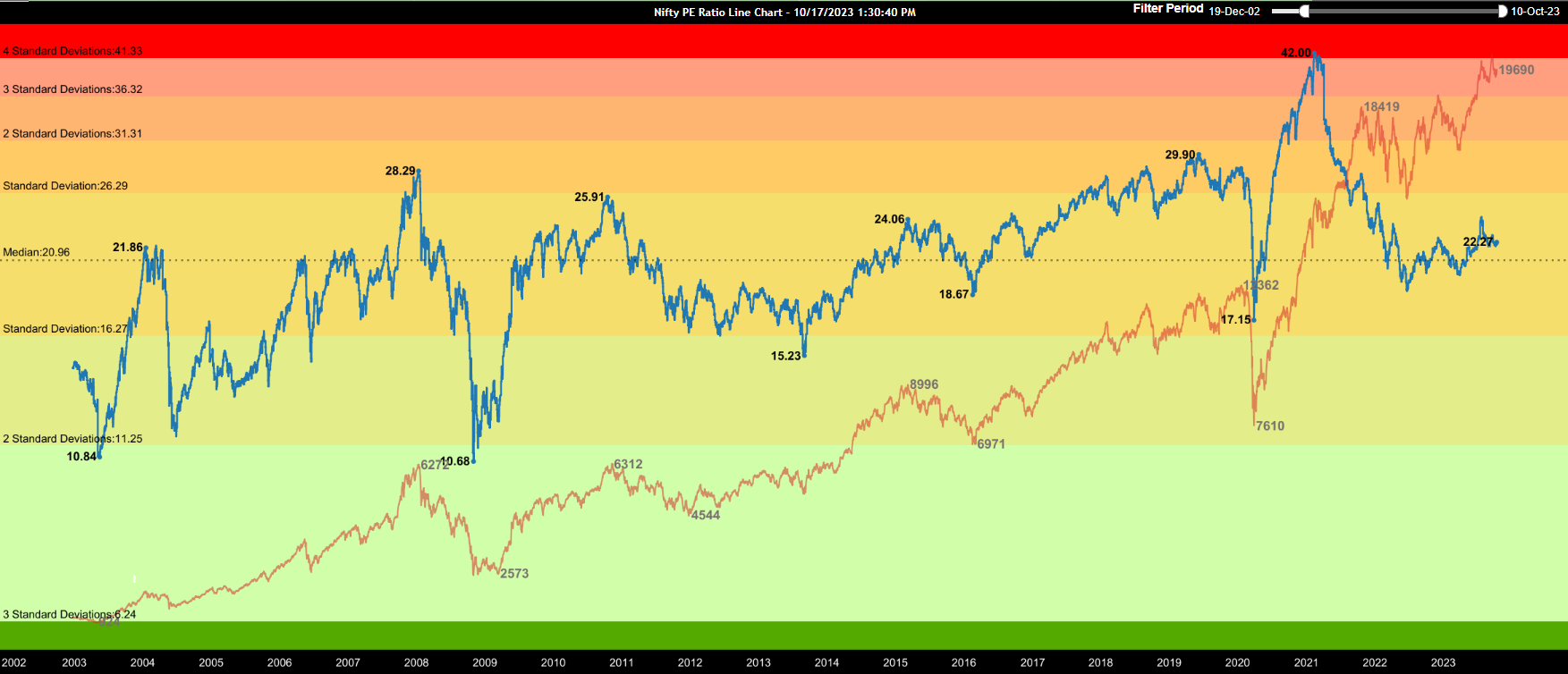

Current valuations to our mind are neither “dirt cheap”, which would salivate a value investor, nor “euphoric” across the board that one would run out of equities. We believe in a more “nuanced” perspective. Pockets could be euphoric and unjustified, but several businesses are poised to structurally grow in earnings and improve their ROEs and brushing the whole gamut with the same color may not be right. Nifty 100 PE is hovering around the median and so is the case of Nifty 50. We see several parts of the economy continue to grow and the EPS story is unlikely to abate making valuations reasonable. We are constructive about the market and encourage our investors to not only hold on but keep adding.

Patience and Equanimity, edges of an Investor

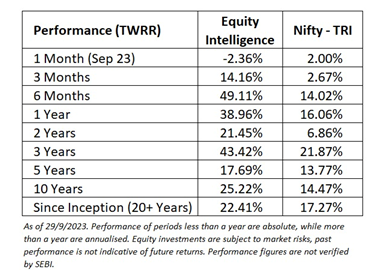

Our long-term returns are superior, and we feel happy that we have been able to add value to our investors who have trusted us for longer periods. However, that doesn’t mean we haven’t gone through intermediate painful periods. Period of 2017-18 especially was extremely treacherous and drawdowns on clients who just joined during the top of that period has taken time to recoup. The very nature of markets is to gyrate and to generate long term compounding intermediate phases of drawdown must be encountered. In true sense, there is no defense against drawdowns if you are committed to a long-term ownership approach to stocks. Keeping patience and equanimity is the true behavioral competitive edge an investor can have over neurotic Mr. Market.

Portfolio positioning remains robust

Sign of good money management is less churn and not more. If one does a good job at the time of purchase, the fruits of that effort should be long-lasting. Churn or no churn should be a consequence of the fundamentals remaining strong or otherwise and not some compulsive neurotic habit driven by impatience and ignorance. Our top holding has seen less churn precisely because despite appreciation they offer improving fundamentals. On an overall basis we remain confident about our portfolio positioning in terms of improving business quality, reasonable valuations, and adequate margin of safety. Our team is geared to uncover great ideas for future compounding and feel passionate and confident to do better than in the past.

“Patience, patience, and more patience. Ben Graham said it, but it is true of all investment disciplines, not only value investing, although it is indispensable to that.” - Peter Cundill

We thank you for your continued trust.

Porinju Veliyath